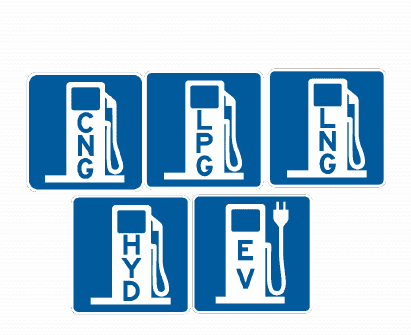

Responding to fleets’ increasing emphasis on fuel diversity and building diverse complements of vehicles, fuel-system and refueling providers are keeping pace by expanding their offerings not only beyond gasoline and diesel, but also beyond the niches they traditionally filled.

Recent activity at California-based Agility Fuel Solutions provides a good case in point. Kathleen Ligocki, the company’s CEO, explains that the scene is shifting to an all-inclusive mode.

“Fleets are looking for portfolio solutions now,” she says, noting that the future of transportation will not be a one-solution-fits-all proposition. “Our goal is to displace diesel, and I think there are a lot of opportunities to do that.”

“Our goal is to displace diesel, and I think there are a lot of opportunities to do that.”

Agility had long focused on high-pressure gas storage and delivery solutions – such as those for compressed natural gas and hydrogen – but executive management recognized the need to also serve new applications. Agility’s 2016 merger with the CNG automotive division of Hexagon Composites was the first major move toward the new all-encompassing “Agility Fuel Solutions” brand. The merger has enabled Agility to enhance its product-development and manufacturing capabilities across all fuel types and create fuel diversity.

In 2017, the organization acquired the assets of CleanFUEL USA, one of the industry’s well-established players in the propane autogas space. Agility Fuel Solutions netted not only CleanFUEL’s suite of autogas fuel system technologies, but also the company’s staff of propane experts. In turn, Agility acquired a turnkey operation that would enable it to add propane to its menu of offerings for fleets.

“We thought we’d enter the propane business organically,” Ligocki says. However, the CleanFUEL acquisition was an ideal way for Agility to accelerate its launch into the low-pressure propane segment – a portion of the alt-fuel universe that is particularly ripe in the medium-duty sector (step vans, box trucks, etc.) and among school bus fleets.

A notable aspect of the CleanFUEL move is that it put Agility’s mark under the hood – literally. Along with an in-house engineering group and an aftermarket support network, CleanFUEL already had a deep portfolio of propane fuel-injection and engine technologies. Those types of technologies – not only low-pressure solutions, but powertrain solutions – were new territory for Agility and reflected the direction the company was turning: a focus “from engine to tailpipe,” explains Charlie Silio, Agility’s vice president of strategy, corporate development and marketing.

“Having many solutions opens up the potential to have a number of conversations with OEMs and fleets,” he says.

The CleanFUEL acquisition was an ideal way for Agility to accelerate its launch into the low-pressure propane segment – a portion of the alt-fuel universe that is particularly ripe in the medium-duty sector (step vans, box trucks, etc.) and among school bus fleets.

Those conversations are increasingly turning to places unheard-of for Agility five years ago (like electrification), as well as to new offshoots of traditional business lines, such as renewable natural gas.

Ligocki is unambiguous about what this all means: “Every kind of clean propulsion will be a part of Agility,” she comments.

Even organizations that hadn’t come from a clean-propulsion background have recognized and responded to the fleet-diversification trend. Love’s Travel Stops is a perfect example: The Oklahoma-based company is a giant among truck-stop and c-store operations, focusing almost exclusively on gasoline and diesel refueling since the mid 1960s – that is, until alternative fuels began growing.

Love’s moved into natural gas refueling at a relatively large scale about five years ago, adding CNG to many of its existing truck stops and increasing its fuel diversity. It enhanced that business line with the acquisition of natural gas refueling infrastructure developer Trillium CNG in 2016.

Bill Cashmareck, managing director of Trillium, notes that the company’s core CNG refueling business among transit, waste and heavy-duty trucking fleets continues to expand, with design/build and O&M services for CNG refueling outpacing retail natural gas sales recently.

Even organizations that hadn’t come from a clean-propulsion background have recognized and responded to the fleet-diversification and fuel diversity trend.

This growth at Trillium has enabled Love’s to extend its reach beyond gasoline and diesel and tap into fleets’ appetite for the price stability and emissions improvements of CNG. And like Agility, Love’s/Trillium is also seeing a new emphasis on renewable natural gas.

Cashmareck says RNG currently represents about 15% of the natural gas that Trillium is pumping. The company’s goal, however, is much higher: 100% penetration of RNG. To achieve that goal, Trillium is looking to not only expand the number of agreements with feedstock plants, but also to own and operate its own RNG production capacity.

“The RNG business is not a five-year business,” Cashmareck cautions.

In fact, the horizon is more like 50 to 100 years, and energy from RNG will dovetail with other clean fuels. For instance, he sees a future where RNG is used to produce electricity that not only charges electric vehicles, but also is used to produce hydrogen for fuel-cell vehicles.

Love’s currently has some EV charging capacity at various travel stops, along with a moderate volume of biodiesel being pumped in some markets. It intends to expand the footprint of both options.

Moreover, Trillium announced in February that it will begin designing, constructing and maintaining hydrogen refueling stations, starting with a project at the Orange County Transportation Authority’s facility in Santa Ana, Calif. – where Trillium built CNG refueling capacity more than 10 years ago.

This station, which will be used to support OCTA’s 10 fuel-cell transit buses, is set to break ground this summer. Air Products will be supplying the hydrogen to the site.

Cashmareck says Trillium will not be building hydrogen refueling infrastructure on spec. The fuel type and fuel-cell vehicles are too new and too limited in production to warrant a widespread network.

However, he confirms that fleets like OCTA are absolutely keeping their eyes open for new opportunities and ways to expand their fuel diversity. And the role for organizations like Love’s/Trillium and Agility Fuel Solutions is to be ready when fleets’ priorities pivot.