Imagine a journey across California that is remarkably different from what we know today. Instead of the familiar polluting and loud diesel trucks, envision a landscape dominated by the quiet hum of heavy-duty electric trucks transporting goods from our ports to warehouses and stores with zero-tailpipe emissions. While this future is within reach – with regulations such as the Advanced Clean Fleets (ACF) Rule pushing fleets to electrify their operations at an increasing rate through 2035 – California needs to overcome multiple significant barriers to make this vision a reality.

Navigating Major Hurdles to Build Infrastructure

According to the California Air Resources Board (CARB), the state’s medium- and heavy-duty electric vehicle (MHDEV) fleet will grow to more than 1.6 million vehicles by 2050, driven by the ACF Rule and complementary Advanced Clean Truck Rule. Although California has made substantial progress in developing charging infrastructure for passenger vehicles with over 41,000 public chargers in operation, the state lags in MHDEV public charging infrastructure.

This trend is concerning, given that in the 2023 State of Sustainable Fleets survey, fleets identified lack of charging infrastructure as a top barrier to electrifying. Investing in public charging stations now will help ensure a smoother uptake of electric trucks and instill increased confidence in the ability for fleets to utilize MHDEVs on routes throughout statewide.

While the projected increase in demand is imminent, developing charging infrastructure for heavy-duty vehicles can be significantly more complex and costly than passenger EV infrastructure. Passenger EVs can be charged at 6-11 kilowatts (kW) overnight, and typically call for 25 to 350kW of power for fast charging using the Combined Charging Standard (CCS) connector. In contrast, many see the heavy-duty trucking industry as needing at least 180kW-350kW on CCS and up to 1 Megawatt (MW) or greater using the Megawatt Charging Standard (MCS) connector for onsite charging infrastructure. This need becomes amplified once you imagine a fully electrified truck stop with multiple 350 kW to 1 MW chargers simultaneously in use. As the industry begins to increase adoption of the new MCS charging standard to enable rapid recharging of trucks, the power needs can be quite significant. This means a typical Truck Depot with 20 trucks will need 7 MW’s or more of site power beyond their depot’s building loads.

From a utility’s perspective, it is very expensive to both deliver and generate power of this magnitude. Upgrades will likely be required on the utility side, including transformer upgrades, trenching, and conduit upgrades. In addition to the utility-side infrastructure, fleets face significant procurement costs, including charger hardware, installation, storage or distributed generation equipment, site construction and grid connection costs, and software fees. When multiple sites require power upgrades, the utility may have to do a substation upgrade, which can take many years to plan and build. As a result, these stations require significant upfront capital to meet the growing demand for electric trucks in the years ahead.

WattEV Leading the Pack While Setting a Significant Roadmap

Despite these challenges, the future is beginning to take shape, spearheaded by early movers like WattEV—a medium- and heavy-duty electric truck charging infrastructure developer that has spent the last three years working to build a West Coast charging corridor that spans from Seattle to San Diego, and now venturing east towards Arizona and beyond.

WattEV’s journey into electrifying the trucking industry is not just about innovative technology – it’s about reimagining logistics for a sustainable era. The company’s development of the first-ever public-access MHDEV charging corridor, epitomized by its pioneering work at the Port of Long Beach, is a testament to this vision. This depot, which serves as the nation’s largest public charging station for heavy-duty electric trucks, not only demonstrates WattEV’s capability as a proven and working provider but also showcases their commitment to practical and scalable solutions across key locations. At full capacity, the Port of Long Beach stations will enable charging for more than 25,000 trucks annually with a total of 26 CCS chargers, and more than 20,000 additional trucks annually with a total of 6 MCS chargers.

While many EV infrastructure providers have laid out detailed roadmaps in the past, few have come to fruition, and none have stayed on track with their roadmap as WattEV has. WattEV’s record continues to be unmatched in terms of on-time delivery of stations and an ironclad commitment to its development plan. This success is due in part to the ongoing and substantial collaboration from partners like the California Energy Commision (CEC), the South Coast Air Quality Management District (AQMD), the Southern California Association of Governments (SCAG) and more federal, state and local agency partners.

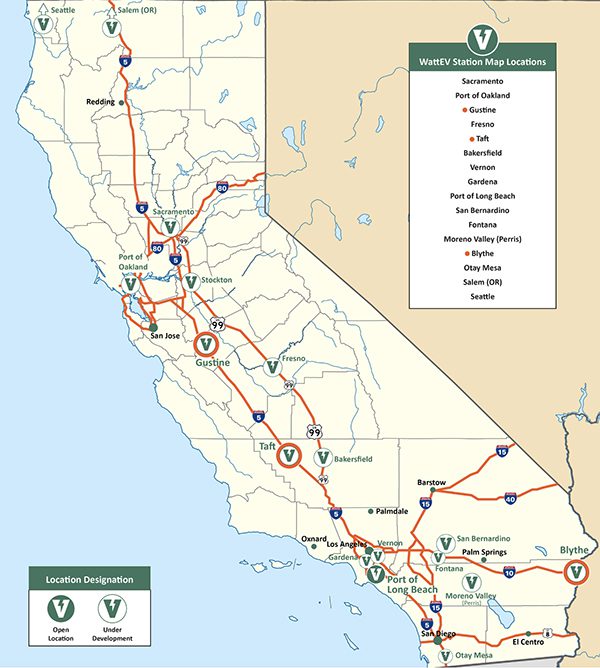

Building on the momentum of its Port of Long Beach depot launch, WattEV has several other locations that are on track to open in early 2024, and many more under development, illustrated in the map below. In fact, just last week, WattEV announced that it had secured a staggering $75.6 million in funding from the Federal Highway Administration to begin building three additional charging depots along crucial freight transportation corridors in California. At full capacity, the three sites will enable charging for more than 92,000 truck charges annually with a total of 205 CCS chargers, and more than 76,000 truck charges annually with a total of 23 MCS chargers. The FHWA grants will enable WattEV to further expand its MCS charging network, which will help truck drivers maximize their uptime by recharging and getting back out on their routes quickly.

Following the announcement, WattEV CEO Salim Youssefzadeh noted, “These substantial investments from the federal government play a pivotal role in advancing the development of essential public truck charging infrastructure, a key factor for the success of commercial freight electrification on the West Coast and beyond.”

A map of WattEV’s current stations and stations under development across the West Coast.

Important Strides Forward, But Much of the Work Remains

Establishing a network of high-powered charging depots requires substantial capital investment. Outside investment and grants provide the necessary financial injection to initiate and expand such projects, fostering a conducive environment for market growth. The California Energy Commision estimates that the MHDEV market “will require 109,000 depot chargers and 5,500 en route chargers in 2030, which grows to 256,000 depot chargers and 8,500 en route chargers in 2035″. This goal signals the need for further investment from federal and state government, as well as private industry players. as well as private industry players.

The advancement of WattEV’s initiatives is not just a win for the company but a stride forward for the entire state’s clean energy goals. The expansion of a robust electric truck charging infrastructure is an essential piece of the puzzle in the larger picture of electrification and emission reduction, particularly in California’s Central Valley which hosts some of the nation’s worst air quality from both the I-5 corridor and Highway 99. This infrastructure is pivotal in supporting the increasing number of electric trucks that will take to the roads in the coming years. While recent funding awards have set the stage for this transformative journey, the path ahead requires sustained support and investment.

WattEV’s early successes have served as a blueprint for a sustainable, economically vibrant, and environmentally responsible California. The ongoing support and investment in such initiatives are not just beneficial but essential for ensuring that the state remains at the forefront of clean energy and transportation innovation, while staying laser focused on its climate goals.