Not only are fleets talking about fuel efficiency; they are actually taking steps to improve the fuel economy of their vehicles. And the results of four different surveys prove it.

The North American Council for Freight Efficiency recently released its 2018 Annual Fleet Fuel Study, a deep-dive investigation into the adoption of various products and practices for improving freight efficiency among 20 major North American fleets.

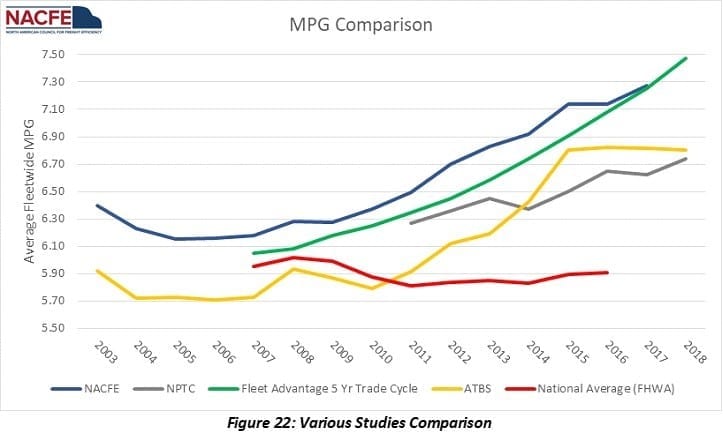

Data from a total of four trucking industry sources, including NACFE, confirms that fleets are moving toward better fuel efficiency on a consistent basis.

The primary finding of this report is that the 20 fleets studied are increasing their rate of adoption of these technologies, and that they are enjoying improved fuel economy as a result. The overall adoption rate for the technologies studied in this report has grown from 17% in 2003 to 44% in 2017.

The average fleet-wide fuel economy of the trucks in this study was 7.28 mpg in 2017 up from 7.14 in 2016, a 2% improvement. What that means is that the fleets are saving $8,864 per truck over the fleets that are at the national average of 5.91 mpg. Put another way, the 20 fleets that are operating 71,844 trucks saved $636,791,023 in 2017 compared to the average trucks on the road.

Fuel Efficiency Mirrored in Four Industry Reports

But one of the most interesting things about the 2018 Annual Fleet Fuel Study was that for the first time three of NACFE’s industry partners — American Truck Business Services, National Private Truck Council and Fleet Advantage — shared their data with NACFE.

All three are showing a similar rate of fuel economy improvement — 2% per year — fleet-wide. This is their overall fleet-wide improvement meaning they are seeing this gain in fuel economy with a combination of their older and newer trucks.

ATBS’ mission is to help change and improve the lives of truck drivers by helping them navigate the complex business and tax environments of the trucking industry. Their work provides ATBS considerable visibility since they have served over 150,000 owner/operators and small fleets. They tend to be the second owner of the truck taken possession of it at about 400,000 miles.

NPTC exclusively serves companies that utilize trucks to support their business, but where trucking is not their main enterprise. Their membership includes companies such as Pepsi, CVS, Deans Foods, Walmart, Meijer and many others. Their 2018 survey group of over 100 fleets had a Class 8 trade cycle of 6.4 years and an average of 651,000 miles at trade-in. The NPTC fleets tend to keep their vehicles longer than typical Class 8 For-Hire fleets, versus 5.25 years for the fleets in the NACFE study.

The four industry partners are showing a similar rate of fuel economy improvement — 2% per year — fleet-wide.

Fleet Advantage is focused on using big data analytics to manage large private fleet costs. They believe that data helps fleets understand total cost of ownership to determine when trucks are economically obsolete rather than functionally obsolete.

Data Sets Tell the Story

What is really interesting is how these data sets match up. In fact it is striking how close the five-year averaged Fleet Advantage numbers are to the NACFE fleets. Fleet Advantage helps carriers spec trucks for their needs with part of their DNA being fuel efficiency.

The NPTC fleets tend to keep their trucks longer. Their fuel economy curve is to the right of the NACFE fleets because their improvements come later, since they buy fewer new trucks each year and then keep those trucks longer.

We are starting to see more of the industry moving toward making changes in their vehicle specs, making investments in add-on technology driver training and incentives, and/or engaging in operational practices that result in them wringing more miles from a gallon of fuel.

The improvement of the ATBS fleets lag the NACFE fleets because they are buying trucks from those fleets and so see the savings later.

It’s important to remember that:

- The fleets that volunteer to supply information to NACFE and NPTC are more than likely to be on the progressive side in adopting new practices since they are benchmarking their operations by participating.

- Fleets leasing through Fleet Advantage are seeking the wisdom and financial operations gains that such a partnership is meant to provide.

- The owner-operators and small fleets who are customers of ATBS are working with them to help make them more profitable.

Fleets are Making Additional Operational Changes

Even given the fact that the fleets in all four of these groups may be more focused on fuel efficiency, there is another big takeaway. We are starting to see more of the industry moving toward making changes in their vehicle specs, making investments in add-on technology driver training and incentives and/or engaging in operational practices that result in them wringing more miles from a gallon of fuel.

It seems like more of us are moving in the same direction toward that 10+MPG goal that was demonstrated by the seven fleets that took part in Run on Less by NACFE. That showed just how far we can go, when we really go all in on fuel economy.