The transportation sector is dependent on oil for 90% of its fuel needs. It is also the nation’s largest emitter of greenhouse gases and a significant source of other air pollutants that negatively affect public health. States, municipalities, and the federal government are increasingly turning their attention to policies that support and accelerate the adoption of electric vehicles (EVs) as a critical tool in the battles against poor air quality, climate change, and economic uncertainties. However, many consumers face roadblocks to buying and maintaining EVs because of antiquated automobile dealership rules. It is time to modernize the car-buying experience in a way that enhances market access and supports consumer choice.

It is time to modernize the car-buying experience in a way that enhances market access to EVs and supports consumer choice.

A growing number of states have set ambitious targets for increasing the sales of zero-emissions vehicles, largely EVs, in the light-duty vehicle segment, as well as the medium- and heavy-duty sectors, and federal commitments are also increasing. At the same time, one auto manufacturer after another is adopting its own EV manufacturing goals and contributing to an investment of more than $460 billion in global private sector support for electrification. All these goals, commitments, and investments must culminate in substantial sales to consumers.

Many EV Focused Companies have Landed on a Direct Sales Model

However, the existing franchise auto dealership model creates unintended barriers to new market entrants like EVs. Dealership staff are well-trained, knowledgeable, and comfortable selling vehicles that burn gasoline. And with national EV sales making up only 2% of the market, these vehicles don’t often garner significant attention from salespeople beyond manufacturer-mandated online trainings. Dealerships and their staff can be underequipped or unable to share information about available financial incentives, charging infrastructure, and other critical details specific to EVs.

To overcome these obstacles, many manufacturers are seeking innovative business models that will bring new vehicles to market quickly while competing with conventional vehicles. Many EV focused companies like Tesla, Rivian, Lucid, Lordstown, and Arrival have landed on a direct-to-consumer business model — commonly referred to as direct sales. As traditional automakers transition to EVs, they too may pursue this approach, with Volvo signaling so already. But for now, there is room for EVs to be sold both by existing franchises and direct sales. This will give consumers, OEMs, and fleets the greatest set of choices, especially as new technology rapidly comes to market. And it will accelerate EV market penetration for all vehicle classes and applications.

Direct Sales have Benefited Dealerships

When you buy a new iPhone, you can go to Best Buy or to an Apple Store. Consumer advocates contend that car shoppers should likewise have access to open markets where dealerships and direct-sales retailers compete to better serve customers. But direct sales channels for vehicle manufacturers are currently limited or prohibited in 29 states by laws that require manufacturers sell their vehicles through franchise dealerships. Meanwhile, dealership and direct sales models have successfully coexisted in open states without negatively affecting dealership jobs or revenues. In fact, dealerships appear to have benefited from open and competitive market conditions. According to data from the National Automobile Dealers Association, in states where direct sales are open to at least one active EV manufacturer, dealerships saw 58% growth in sales revenue from 2012 to 2019. Over the same period, closed states only saw 29% growth. Nationwide, dealership employment grew by 18% during this period, and open states fared better: 21% in open states versus 12% in closed states. Dealerships can and will successfully do business alongside a direct sales model as long as they continue to innovate to meet the needs of their customers.

Dealerships appear to have benefited from open and competitive market conditions, it supports EV adoption.

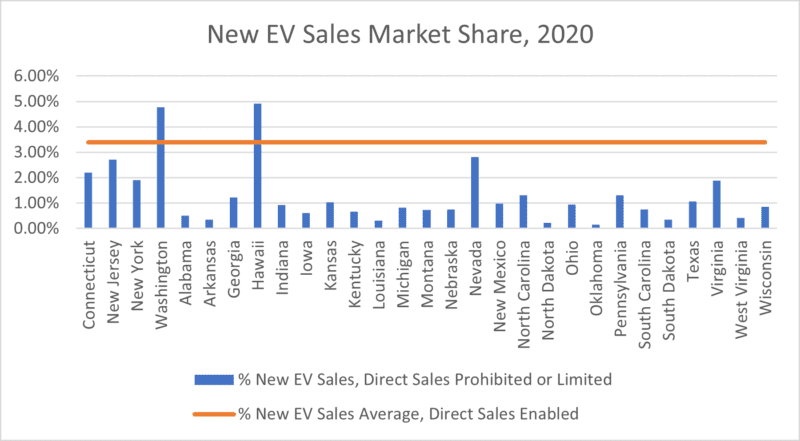

Allowing direct sales will help to support the transition away from conventional vehicles, develop our domestic supply chains, and bring EVs to market more quickly. Early sales data indicate that markedly more EVs are sold in states with direct sales than in states where such channels are prohibited. In 2019, open states had an average EV market share of 3.4%, versus 1.3% in closed states.

Enabling direct sales and allowing EV manufacturers to participate and compete in an open market is a must for accelerating EV adoption while simultaneously enhancing consumer choice. Direct sales prohibitions will continue to slow EV adoption, limit competition, hinder consumers’ freedom of choice, and reduce vehicle reliability for EV drivers. Opening the door to direct sales for EV manufacturers should be a high priority for states to create competitive and open markets, protect and enhance consumer interests, and support widespread EV adoption.