Although the U.S. had achieved important pollution targets by the end of the 20th century, its power production and transportation sectors – two major engines of the economy – remained top producers of air pollutants and greenhouse gases (GHGs). Although GHGs were not regulated before 2009, Congress introduced a transportation-specific program in 2005 that sought to address three major concerns at that time: energy security, rural economies, and environmental protection.

Known as the Renewable Fuel Standard (RFS), this market-based program was launched under the Clean Air Act (CAA) in 2005 to reduce the carbon content of transportation and heating fuels in the U.S. by increasing the share of fuel consumed that was renewable. The RFS requires petroleum refiners and importers (“obligated” parties) to incorporate biofuels into their sales mix, supporting a production target of 36 billion gallons by 2022. Each year, these obligated parties must meet a Renewable Volume Obligation (RVO), established annually by the EPA, by either blending biofuels into their petroleum or purchasing credits from biofuel producers. The RFS mandatory purchase of renewables and associated credits has helped grow a diverse biofuel industry by sustaining investment and reducing end-user fuel costs and remains an influential factor in the role of liquid biofuels in a low-carbon transportation future.

The RFS mandatory purchase of renewables and associated credits has helped grow a diverse biofuel industry by sustaining investment.

Breaking down the RFS Categories

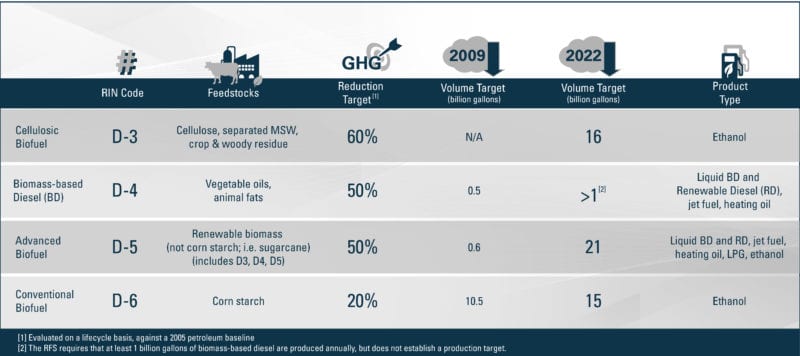

The RFS categorizes biofuels according to their feedstock, as shown in the table below. The EPA assigns biofuels to these categories according to their pathway, as defined by the biofuel producer, a process which is often time intensive. The four primary categories are cellulosic biofuel (D-3), bio-based diesel (D-4), advanced biofuel (D-5), and conventional biofuel (D-6).

Conventional biofuel and bio-based diesel have consistently met their annual production targets, due in part to the effect of the blend wall on demand. These fuels are primarily used in low blend ratios with petroleum, often less than 20%, as higher blend ratios tend to have a negative effect on vehicle engine performance. Since petroleum consumption is steady, this performance limitation caps the amount of ethanol that the market can physically consume. By contrast, the target for biomass-based diesel serves as a production floor to stimulate this smaller and capital-intensive industry. Meanwhile, cellulosic and advanced biofuels have fallen short of their targets due to similar production and scaling challenges. For example, in 2019, cellulosic biofuel production was just over 414 million gallons – well short of its 8.5 billion gallon target that year.

The RFS categorizes biofuels according to their feedstock, in four primary categories.

Generating and Trading RINs

Fuel categories also reflect their energy content relative to ethanol, on a per gallon basis, and this drives its Renewable Identification Number (RIN) generation potential. RINs are effectively tradeable credits that obligated parties must buy to offset their deficits from the production or sale of petroleum fuel. RINs are generated when a gallon of renewable fuel is produced, and the higher the relative energy content of that fuel compared to ethanol, the more RINs that gallon will generate. For example, 1 gallon of biomass-based diesel has 1.5x the energy content of corn-based ethanol, therefore that gallon will yield 1.5 RINs.

The fuel categories reflect their energy content relative to ethanol, on a per gallon basis, driving RIN generation potential.

RINs may be purchased in two ways: attached to the fuel that the buyer is procuring (assigned RINs) or on a stand-alone basis from the fuel (separated RINs). RIN prices vary according to their RFS-assigned D-code, but historically, D-4, -5 and -6 RINs have been priced around $0.50 while D-3 prices have exceeded $1.00. Purchasing RINs does not satisfy a buyer’s compliance obligation – once a transaction has been made, the buyer must retire the RIN in the year that it is intended to support the buyer’s compliance obligation. A RIN must be retired by the end of the year after its sale, and within five years of being generated, at which point it cannot be used again. This helps sustain market activity. Since 2010, the number of RINs generated per year, and accordingly, the gallons of renewable fuel produced, has grown steadily from 7 billion to nearly 20 billion, with the majority being D-4 and D-6 RINs associated with the stronger production sectors described earlier. D-3 RINs are the least common.

Since 2010, the number of RINs generated per year has grown steadily from 7 billion to nearly 20 billion.

RFS and You – What it Means for Fuel Producers

While the core tenets of the RFS have been established since 2005, the program has faced significant regulatory uncertainty over the years, and this has contributed to the unsteady performance of some biofuel sectors. The annual adjustment to the RVO must be informed by industry data that is rarely available in real time and is often of a mixed quality. Additionally, refinery exemption requests must be considered – and issued – each year, affecting demand estimates. These processes are frequently delayed – particularly in years with significant government turnover – and this has introduced significant financial uncertainty to the biofuels market. While the volume targets established for 2022 remain in place, it appears increasingly unlikely that the market will be able to achieve those thresholds without significant policy support. The EPA’s definition of the RFS targets after 2022 will be important for determining the role of the biofuels in the U.S. low carbon fuel transition.

Transitioning Transportation to a Low-Carbon Economy

Energy markets have long been dynamic drivers of the global economy, and in 2020, they have faced a series of unprecedented prompts for transformation. Responding to crises of public health, climate, the economy, and national security, many oil majors have committed to transitioning to low or even zero carbon operations and products. Initiating and sustaining this shift, particularly in the early years, will be a complex and costly endeavor. The continued development and implementation of market-based programs like the RFS is an important component of the U.S. strategy for a low-carbon future.