After almost a year since the proposed rule was introduced, the U.S. Environmental Protection Agency (EPA) has finalized its Phase 3 emission standards, ruffling more than a few feathers along the way.

The final rule, “Greenhouse Gas Emissions Standards for Heavy-Duty Vehicles — Phase 3,” applies to all heavy-duty vocational vehicles, from Class 8 tractors to school buses, and looks to drastically cut emissions in model year 2027 to 2032 vehicles. The newly announced standards are being labeled as “unachievable” by the American Trucking Associations (ATA).

“Given the wide range of operations required of our industry to keep the economy running, a successful emission regulation must be technology neutral and cannot be one-size-fits-all. Any regulation that fails to account for the operational realities of trucking will set the industry and America’s supply chain up for failure,” said ATA President and CEO Chris Spear.

A Call for Increased Zero-Emission Vehicles

While the adopted standard does not rule out internal combustion engines, it certainly puts more pressure on fleets to adopt zero-emission (ZE) technologies, such as battery-electric and hydrogen fuel cell vehicles. Taking advantage of what the EPA called “projected available and cost-reasonable motor vehicle technologies,” the standards look to current and developing clean vehicle technologies to further reduce emissions throughout the industry.

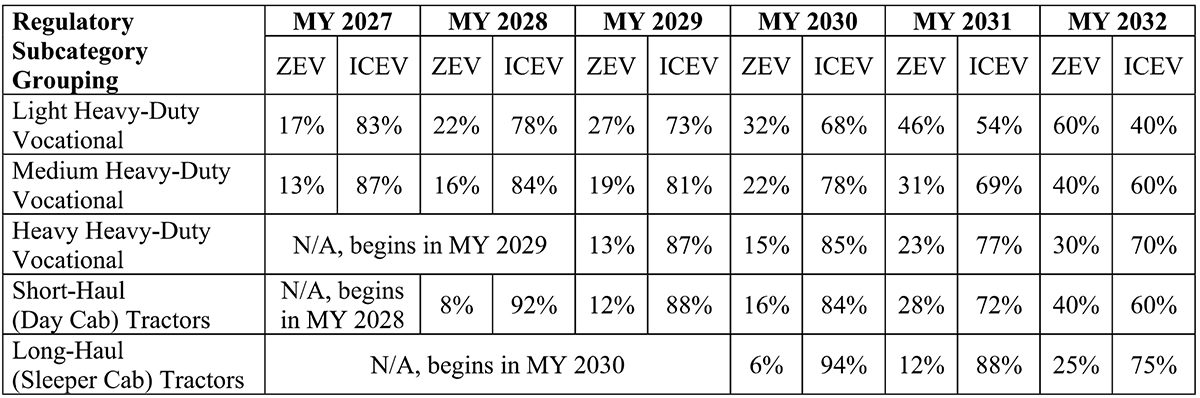

Starting with MY 2027, light heavy-duty vehicles are projected to be split between ZE and internal combustion engines (ICE) 17% and 83%, respectively. Day cab tractors, which do not see a change in the mix until MY 2028, are expected to consist of 8% ZE and 92% ICE vehicles. The long-haul sector is not projected to see a similar adoption until MY 2030, with 6% ZE and 94% ICE. Even with the lead time for development and adoption of these technologies, some are wary of these projections.

Image: U.S. EPA

The Clean Freight Coalition (CFC), which includes member associations such as ATA, released a statement when the rule was published, opposing the changes and calling it “a regulation that will require the adoption of zero-emissions commercial vehicles at a pace that isn’t possible due to the limits of today’s technology.”

“Today, these vehicles fail to meet the operational demands of many motor carrier applications, reduce the payload of trucks and thereby require more trucks to haul the same amount of freight, and lack sufficient charging and alternative fueling infrastructure to support adoption,” said CFC Executive Director Jim Mullen in his statement. “These commercial vehicles are in their infancy and are just now being tested and validated with real world-miles.”

The CFC released a report in March that projects a cost close to $1 trillion to fully electrifying medium- and heavy-duty commercial vehicles in the U.S., including the necessary charging infrastructure to afford an industry-wide adoption.

“The GHG Phase 3 rule will have detrimental ramifications to the commercial vehicle industry, many small and large businesses, commercial vehicle dealers and their customers,” added Mullen.

Industry Reactions Mixed Bag

In a lead up to the finalized rule, OEMs such as Cummins, Ford, BorgWarner, and Eaton threw their support behind the EPA this past February, applauding the planned changes to the emission standards. The alliance, known as the Heavy-Duty Leadership Group, released a joint “Statement of Principles,” rejecting an earlier call to push the changes to MY 2030 vehicles.

“We are stepping up — once again — to join the group to support EPA finalizing a tough, clear and enforceable Phase 3 final rule. Phase 3 will provide the regulatory certainty needed to drive industry-wide investment to deliver our next generation of decarbonization technologies,” said Shelley Knust, Vice President of Product Compliance and Regulatory Affairs at Cummins.

Scott Adams, senior vice president, Global Products, for Eaton’s Mobility Group, stated the company is also “prepared to support emissions reduction goals with advanced powertrain and electrified vehicle technologies that can help achieve the standards in EPA’s proposed Phase 3 Heavy Duty Greenhouse Gas rule in model year 2027.”

Alex Voets with Velocity EV, who leads the North American brand launch for RIZON trucks by Daimler, said, “This rule will make combustion engine trucks more expensive, as OEMs work to add emissions equipment to engines, and we think that added cost and complexity will tip the scale towards battery-electric trucks, especially in smaller Class 4-5 trucks like RIZON, where the vehicle and charging are already affordable.”

“Following the release of the Zero Emission Freight Corridor Strategy, the new EPA regulation sends another important signal that will lead to more planning certainty for fleets in the energy transition, said Matt Horton, CEO of Voltera. “These signals will continue to increase the pace and volume of infrastructure development, which strengthens Voltera’s ability to enable fleets to benefit from the transition.”

Other groups, such as the Natural Resources Defense Council (NRDC), were not as quick to throw their support behind the move.

“While EPA’s Phase 3 rule is one step closer to reaching our climate goals, it falls short addressing the full spectrum of challenges posed by HDV emissions,” wrote Guillermo A. Ortiz, Clean Vehicles Advocate, Climate & Energy, at the NRDC. “Going forward, a comprehensive, all-of-government approach is needed to address the daily toll inflicted on environmental justice communities. Until that message is heard clearly and acted upon, environmental justice communities will continue to bear the public health and environmental consequences of the global freight system.”

Projected Benefits, Savings of Rule

Calling the update to 2016’s Phase 2 “appropriate and feasible considering cost, lead time, and other relevant factors,” the EPA stated the final rule will produce an estimated $13 billion in net annualized benefits through the year 2055, with $10 billion in annualized climate benefits and another $300 million in annualized benefits from reduced emissions of fine particulate matter.

The agency also pointed to the savings available to fleets through the Inflation Reduction Act. According to the EPA, those purchasing MY 2032 zero-emission vocational vehicles and day cabs will see reduced upfront costs of the vehicles, as well as the ability to recoup additional costs related to vehicle charging equipment within two to four years. This would increase to five years for sleeper cabs. An annual savings of $3,700 and $10,500 on fuel and maintenance costs is also feasible, depending on the vehicle type, according to the EPA’s projections.