As the coronavirus and oil price wars in Russia and the Middle East send shockwaves across the global economy, CNG provides fleet operators with unmatched opportunity to stabilize fuel costs.

By: Ryan Forrest

Sponsored By: Trillium

In an increasingly connected world, unpredictable international events can send shockwaves through our markets overnight. Whether that be disruptions in fuel supply, the fear of impending regulations, global trade tensions or an economic recession—all of which we have seen in the last year—it is no longer a question of if these global events will impact US fuel prices, but when. In 2019, prices for oil have reached as high as $85.83 per barrel and fallen to $50.49 per barrel—a 70% price difference (InfoMine). In 2020, with the impacts of COVID-19 on the global economy, we are seeing prices plummet. Prices as of end of March and early April 2020 are between $25 and $35 per barrel.

For commercial fleets seeking price stability and cost-competitiveness, this uncertainty makes long-term operational planning a challenge. Particularly in times when prices are falling drastically, it seems like a golden opportunity for fleets to reduce fuel costs. However, fleets can get burned on fuel costs when prices inevitably go back up. How can fleets plan for these types of price swings throughout the year, let alone plan for the next five years? Fortunately, one fuel offers fleets safe harbor from this volatility: domestic, price-stable natural gas. And there’s sound reason why.

Proving it at the Pump

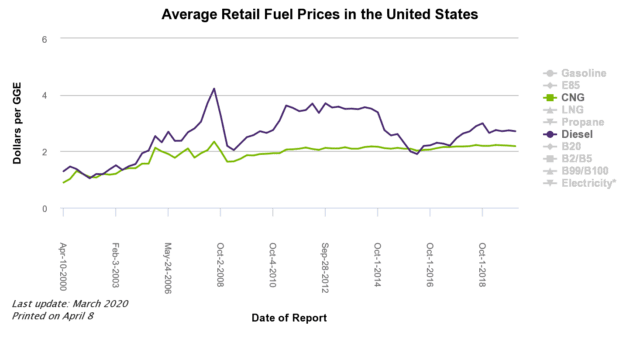

The market for natural gas is more stable than diesel and it shows in the price paid at the pump. Over the past 10 years, the national average price for compressed natural gas (CNG) has hovered around $2 per gasoline gallon equivalent (GGE) while diesel prices have varied by almost the same amount. (US DOE Alternative Fuels Data Center).

Source: DOE Alternative Fuels Data Center

There are two primary reasons for natural gas’ price stability when compared to diesel. First, natural gas is a domestically produced fuel, largely buffering it from import costs and other price variability. Second, prices for natural gas are more heavily determined by domestic market forces, making it less susceptible to price swings from unpredictable and tumultuous global events, like the unfortunate global pandemic of COVID-19. Both factors help ensure fleets continue to pay a stable price at the pump and can help fleets more effectively and confidently plan for the long-term.

An Abundant, Domestic Fuel

The majority of the natural gas that the U.S. consumes is produced domestically. With abundant domestic supplies, the U.S. can meet its own demand for natural gas while exporting the excess. In fact, in 2017, the U.S. became a net exporter of natural gas, selling our excess natural gas on the global market.

Incidentally, the U.S. also produces almost as much oil as it consumes. U.S. oil production is approximately 18 million barrels per day and consumption is around 21 million barrels per day (EIA). However, U.S. producers get attractive prices on the global market and therefore sell about half of all U.S.-produced oil internationally. To fill the gap for consumers at home, the U.S. relies on imports, the price of which is naturally susceptible to global factors (EIA).

Market-Driven Prices

The price stability of natural gas is largely tied to production efficiencies and a direct relationship between supply and demand. Natural gas supply has been steadily climbing alongside demand, while production and refining continue to become more efficient, only helping to add to natural gas’ price stability.

Market experts predict the stability and price-competitiveness of natural gas is a factor fleets can rely on for years to come.

A Renewable Fuel Offering Even More Benefits

Market experts predict the stability and price-competitiveness of natural gas is a factor fleets can rely on for years to come. The recent development of sources for renewable natural gas offers even more promise for the market, with huge climate benefits and improved air quality. Produced from organic sources including waste from dairy farms, municipal solid waste and landfills, renewable natural gas (RNG) is an abundant, price stable and seamless fuel replacement for fleets that already operate on natural gas.

In addition to offering this gas as a fuel, producers can sell RNG’s low carbon attributes through market-based incentive programs including the Federal Renewable Fuel Standard program (RFS) and California’s Low Carbon Fuel Standard (LCFS) program. The revenue generated by these programs reduces the cost of production, enabling producers and distributors to consistently offer fleets the most competitive price.

Operating with Price Confidence

Fueling with natural gas helps fleets to eliminate price uncertainty and minimizes their highest variable cost – the price of fuel. Fleets can have the confidence to plan for the long-term without the worry of price spikes and unpredictable costs.

Learn more about Trillium’s portfolio of fueling solutions visit www.loves.com/trillium or contact Ryan Forrest at ryan.forrest@trilliumcng.com

__

About the Author:

Ryan Forrest is the Western United States Region Manager at Trillium, which is a member of the Love’s Family of Companies and is a leading developer of alternative fueling system design and provides installation and operations for innovative energy solutions. In this role, Forrest manages the infrastructure market development of natural gas, hydrogen, battery electric, and solar in the alternative fuels and transportation industries for the western region. With nearly a decade of experience working in multiple segments of the energy industry, including for the US government and as an independent consultant, he specializes in local and state legislative affairs, fleet and supply chain management, and business development.