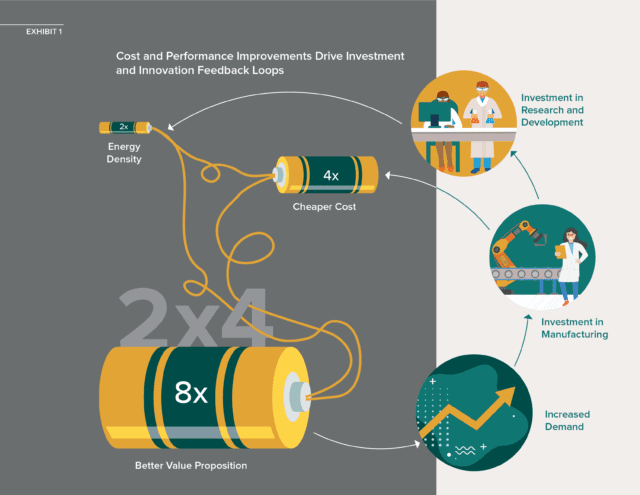

Rocky Mountain Institute, in the recent report Breakthrough Batteries, shows how recent and rapid improvements in lithium-ion (Li-ion) battery costs and performance, coupled with growing electric vehicle (EV) adoption targets and demand in an increasing number of markets, have unlocked enormous investment into the advanced battery technology ecosystem. While a number of startups are charting their path to significant battery improvements, more telling is large scale of investment into both manufacturing capacity and research and development programs. Total manufacturing investment, previous and planned until 2023, represents $150 billion, or close to $20 for every person in the world. This is poised to dramatically shift how we power and organize our lives and energy systems over the next decade.

Compounding Improvements

Recent and rapid improvements in Li-ion battery costs and performance have unlocked investment into the advanced battery technology ecosystem.

Industry observers have suggested that the market development path for Li-ion batteries will follow that of solar photovoltaics (PV), wherein a single technology (crystalline silicon) quickly dominated other technologies by driving down costs through economies of scale. This is crucially different from the battery market, where performance differentiation and improvements are inherently more important and are key factors driving increased market growth.

Li-ion batteries are already differentiated in terms of their component parts due to the divergent operational and design needs of various battery use cases. In other words, companies will optimize Li-ion batteries with substantially different components and performance attributes for applications such as EVs, scooters, laptops, or grid-scale batteries. This means that the innovation space for batteries is diverse. And more battery demand is eliciting not only improvements of economies of scale, but also resulting in superior batteries and non-linear market growth, as better and cheaper batteries open new market segments.

No One Battery Chemistry Is Likely to Rule Them All

While batteries continue to diversify and improve in many directions, the history of batteries is one of tradeoffs. The cheapest battery is unlikely to be the safest; the battery with the highest energy density is unlikely to have the longest lifetime. While much of the industry moves toward the Li-ion cathode chemistry NMC (nickel manganese cobalt), other types include LFP (lithium iron phosphate), NCA (lithium nickel cobalt aluminum oxide), LTO (lithium-titanate), and LCO (lithium-cobalt oxide). The composition and qualities of the NMC cathode itself is undergoing intense innovation and investment, largely to reduce the amount of cobalt content due to supply volatility and human rights concerns. No single battery chemistry is likely to be a silver bullet on all attributes, keeping the door open for other energy storage technologies to play complementary roles in additional applications and market segments.

What Might Battery Performance Improvements Enable for Mobility?

The scale of investment flowing into the space today suggests that the rate of change is entering a new, and much faster, phase of improvement.

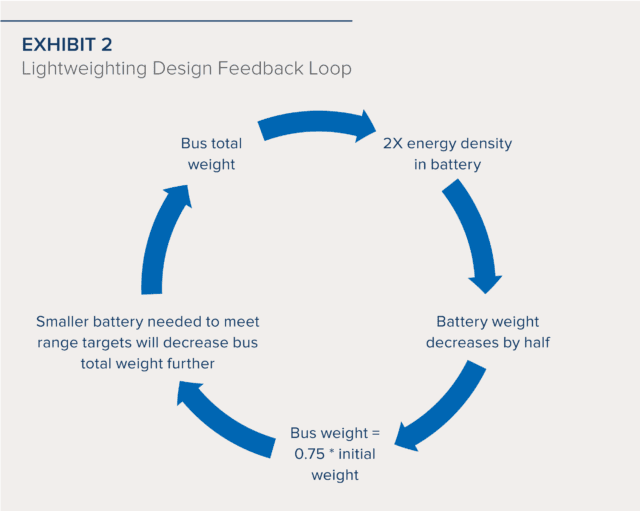

Deep discharges of Li-ion batteries significantly decrease their cycle life, while shallow discharges have a much smaller impact. EV battery innovators have realized that they do not need numerous deep discharges on a battery, as the vast majority of trips are short distances. Therefore, innovators for mobility applications are likely to spend more effort optimizing for energy density and safety in addition to looking for continual cost declines over improvements in cycle life with deep discharges. Additionally, improvements in energy density (energy per volume), specific energy (energy per weight), and safety can enable compounding systems design cost savings, since smaller batteries are needed for lighter and smaller vehicles. Exhibit 2 illustrates how increasing energy density can have a compounding effect on the total weight of an electric bus, and therefore the size of the battery required.

Many, if not most, major battery manufacturers are devoting large efforts to improve these attributes, as well as to decrease costs. Some of the most prominent innovation areas include the use of silicon anodes and improved electrolytes, including solid state electrolytes. While both improvements could significantly increase energy density, solid state electrolytes are especially likely to also help improve safety and may enable new battery types to enter the market. Some of these battery technologies have the potential to be extremely cheap or energy dense and could further diversify the battery market. Super low-cost batteries are likely to target two and three-wheeler markets, whereas heavier applications are more likely to find value in batteries with high energy density.

Integrating Mobility into the Grid

Vehicle-to-grid (V2G) capabilities have been identified as a key opportunity for EVs to provide benefits back to the electric grid (in exchange for the large amount of power their charging will require). However, given the history of trade offs in the battery sector and the type of batteries that are best suited for mobility applications, it is unclear whether vehicle manufacturers are keen to enable or even allow V2G interaction. Any additional burden or degradation that V2G capabilities place on a car’s battery will need to be considered in the manufacturer’s pricing and warranty of that battery and vehicle. As such, it is worth evaluating whether other battery technologies that are not degraded by fast charge and discharge cycles that are frequent and deep may be better suited for managing a large network of EVs while also providing grid balancing capabilities through integration into the EV charging equipment. Technologies that may be well suited to play this role include flow batteries, high-power batteries, and high-temperature batteries. These technologies have enjoyed long research and development periods and are now reaching a point where they are beginning to be deployed at scale with competitive costs, especially on a levelized-cost basis.

Current and future investors in the battery space have an unprecedented opportunity to maximize value in exciting new markets by leaning into a diverse battery ecosystem.

While historical evolution and improvements in batteries have been significant, the scale of investment flowing into the space today suggests that the rate of change is entering a new, and much faster, phase of improvement. Batteries will likely diversify in terms of the types and markets for which they are best suited. Certain battery technologies, including different types of lithium ion batteries, may be better suited for grid balancing applications, while others target light-duty electric vehicles or fast charging. Investors should cultivate the ability to compare opportunities based on integrated system designs using levelized costs as a basis for decision making. Current and future investors in the battery space have an unprecedented opportunity to maximize value in diverse and exciting new markets by leaning into, not away from, a diverse battery ecosystem.