In partnership with: Pacific Gas & Electric Company (PG&E)

California is a world leader when it comes to adopting of electric vehicles (EVs). State regulators recently doubled down on efforts to electrify the transportation sector with the approval of the Advanced Clean Truck sales mandate in June 2020. With increasing state regulations and corporate commitments to reduce transportation-related emissions, more medium- and heavy-duty fleets are considering the transition to EVs.

As businesses begin to invest in the next generation of EV technology, the higher upfront costs of EVs can be a barrier. However, these higher initial costs, such as the purchase of new vehicles and the installation of necessary charging infrastructure, can be offset by the lower operating expenses associated with EVs. In fact, many businesses will realize that the total cost of ownership (TCO)—the costs of buying, operating, and maintaining a fleet of EVs over the life of the vehicles—will be less than a fleet of diesel or gasoline vehicles.

Cost Factors to Consider for EVs

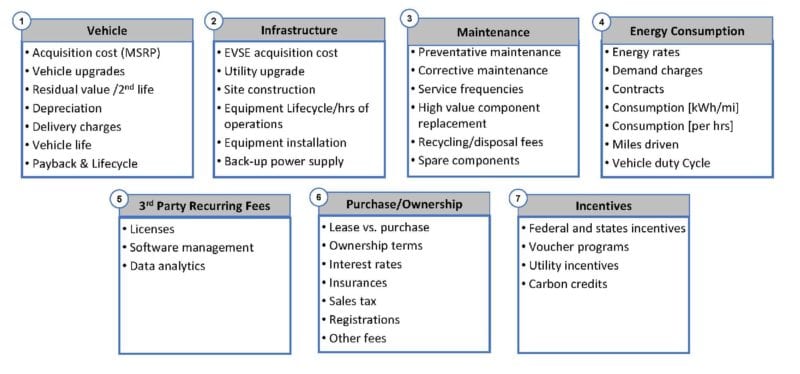

There are many factors that should be considered when determining the potential TCO savings fleets could realize from EVs. This includes reductions in fuel and maintenance expenses, as well as, the monetary and non-monetary incentives that are widely available in California for the purchase of EVs and the installation of Electric Vehicle Service Equipment (EVSE, or chargers). Some of the factors to consider are summarized in Figure 1 below.

Figure 1: Factors to Consider When Electrifying Your Fleet

The first cost fleets encounter when transitioning to EVs is the higher cost of the vehicle. Today, the price of a new EV can range from $100,000 to $200,000 for a Class 4-6 walk-in or delivery truck to $300,000 or more for a Class 8 over-the-road truck. Compared to the cost of a new diesel medium- or heavy-duty vehicle, the price of a new EV could be as much as double its diesel counterpart. Although these list prices will inevitably fall with increased production and sales, EVs are anticipated to command a premium relative to their conventionally fueled counterparts for the next decade.

Another increased expense that fleet managers must consider is that higher sales taxes accompany higher vehicle prices. For Class 8 electric trucks, higher sales taxes will be compounded by a 12% Federal Excise Tax (FET).

Available funding all but guarantees that the TCO of EVs crushes that of their dirtier competitors.

Fortunately, state and local governments in California are encouraging the replacement of medium- and heavy-duty diesel trucks with zero-emission EVs through tens of millions of dollars in funding available each year to help businesses buy down the cost of EVs. Not only does this help make the entry cost for electrifying a fleet comparable to diesel, but as will be demonstrated, it all but guarantees that the TCO of EVs crushes that of their dirtier competitors.

At the state level, the most prominent incentives to support new EV purchases are the Heavy-Duty Vehicle Incentive Program (HVIP) and the Carl Moyer Memorial Air Quality Standards Attainment Program (CMP), which is administered by local air quality agencies. HVIP is a voucher applied at the point of sale to qualifying vehicles, while the CMP is both a voucher and a grant program. Requirements to receive funding vary across Air Districts, but PG&E can help fleets determine which incentive program makes the most sense for your needs. See a list of all available funding programs on PG&E’s EV Fleet Savings Calculator.

Reduced Fuel and Maintenance Powers Costs-Savings for EVs

While higher vehicle costs can appear to be a barrier to electrification, the EV price premium can be offset by incentives. Yet, even without incentives, the lower operating expense of medium and heavy-duty EVs can make their TCO extremely attractive.

In real-world fleet testing, EVs experience significantly fewer maintenance needs, major repairs, and downtime compared to diesel and gas vehicles. This is because EVs do not require upkeep on such high-ticket maintenance items like oil and filter changes, exhaust after-treatment maintenance, and diesel emission fluid (DEF) replacement. Maintenance and repair of internal combustion engine components like spark plugs, fuel injectors, carburetors, water pumps, belts, and transmissions are all no longer needed. The California Air Resources Board (CARB) estimates that a Class 8 electric truck will cost 4.7 cents a mile less to maintain than its diesel cousin. Over the lifetime of a typical medium- or heavy-duty vehicle fleet, these reduced maintenance costs could easily result in hundreds of thousands of dollars in savings.

In addition to maintenance and repair savings, EV owners will save on fuel costs. This is due to two factors:

- EVs are more energy-efficient, and

- Electricity costs less on a per-mile traveled basis diesel.

Once the electricity makes it into a vehicle’s battery, over three-quarters of that energy is converted into motion. The best heavy-duty diesel engines, on the other hand, convert between 35% – 45% of the latent energy in the liquid fuel to motion. The rest is lost heat that escapes out of the exhaust. EVs also have the advantage of regaining some energy from regenerative braking, which contributes to their superior efficiency.

EVs experience significantly fewer maintenance needs and major repairs compared to diesel and gas vehicles.

Additionally, electricity is often cheaper than oil. Today the average price of a gallon of California diesel is $3.36, while PG&E’s off-peak price of electricity is $0.14 per kilowatt/hour (kWh). A new Class 6 diesel local delivery truck may get 10 miles per gallon, which works out to about $0.34/mile in fuel costs. A new Class 6 electric delivery truck, on the other hand, will require 1.5 kWh to go one mile, or $0.21/mile. That $0.13/mile fuel savings, coupled with the reduced maintenance costs, can save the EV owner $4,000 per year (assuming 25,000 miles a year), or $40,000 over a ten-year vehicle life. And, with EVs, the more miles the truck drives, the more money the owner saves. See an example of a TCO analysis for a Class 3 delivery van here and a Class 3 shuttle van here.

Plug into EV Charging Infrastructure Savings

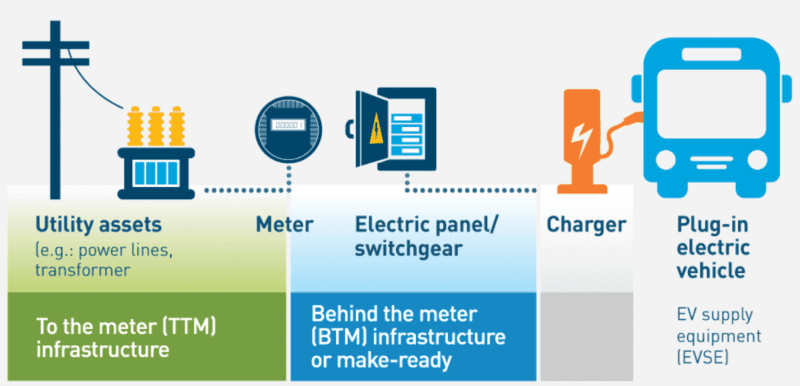

Calculating TCO is not only about operating expense savings. After determining the operating and fuel costs, fleets will need to consider the cost of installing new electric charging infrastructure as seen in Figure 2.

Figure 2: EV Charging Infrastructure Overview

EV charging infrastructure includes three components: to-the-meter (TTM), behind-the-meter (BTM), and the charger. The TTM infrastructure consists of utility assets, such as power lines and transformers. The BTM infrastructure involves the electric panel and equipment needed to connect to the charger.

For diesel and other gas-powered vehicles, the fueling infrastructure is likely already readily available and is not a significant cost consideration. For EVs, the total cost of EV charging infrastructure can range from thousands to tens of thousands of dollars depending on the location, readiness to connect to the grid, fleet size, and energy needs. Many utilities, including PG&E, have launched programs aimed at helping fleets switch to electric by offering rebates and incentives to reduce the cost of the charging infrastructure. For example, through PG&E’s EV Fleet program, fleet customers can receive between $3,000 to $9,000 per vehicle to help pay for the BTM design and construction, while PG&E will pay for and build the TTM infrastructure. Schools, transit agencies, and fleets operating in disadvantaged communities can receive rebates up to 50% of the cost of the chargers. Learn more about PG&E’s EV Fleet incentives and rebates here.

Through PG&E’s EV Fleet program, fleet customers can receive between $3,000 to $9,000 per vehicle.

CARB estimates that before available incentives, the cost per medium- and heavy-duty electric truck adds about $8,400 to the annual cost of the vehicle. When that charging infrastructure is supported by public resources or, even better, when a 3rd party vendor is willing to invest their capital to build the charging infrastructure for the fleet in exchange for a long-term supply agreement, charging infrastructure costs can be mitigated.

In addition to learning about the available funding incentives and the companies that want your charging business, working with your local utility early on in the electrification process can be beneficial to help design the site, determine energy needs, and connect you with other helpful resources—all of which could expedite your transition to EVs and increase cost-savings opportunities.

EVs Can Make Money

Thus far, we have shown how EVs are cheaper to fuel and maintain, and how higher vehicle costs and new infrastructure needs can be offset by incentives and rebates. Yet, there is one additional factor that makes EV TCO such a winner for businesses. Electric truck owners can make money just by operating their zero-emission vehicles. In California, this is done by registering the vehicle with the state’s Low Carbon Fuel Standard (LCFS) program.

EV fleets have the potential to earn tens of thousands of dollars annually under LCFS.

The LCFS is a market-based, fuel-neutral program designed to reduce the carbon intensity of traditional transportation fuels. Users and producers of low carbon transportation fuels earn LCFS credits through the emission reductions generated by operating their cleaner vehicle. EVs can generate LCFS credits, which can then be sold to regulated entities, such as importers, producers, and refiners of petroleum fuels, that are required to reduce the carbon intensity of the transportation fuels they sell in-state. EV fleets have the potential to earn tens of thousands of dollars annually. For example, a fleet operating a Class 6 electric box truck could earn up to $7,000 for the vehicle annually, which is revenue that could be used to pay for the cost of fuel, vehicle maintenance, or the purchase of additional EVs. Learn more about the LCFS program in a recent webinar.

The TCO of EVs is a Winner

When it is all added together, the TCO of EV medium- and heavy-duty vehicles presents an overwhelming case for the cleaner technology. More so, it will be the early adopters who are best positioned to benefit from EVs, as they will purchase the technology while the incentive programs are at their peak. As electric technology advances and the use of EVs becomes more widely adopted, the cost of EVs will continue to decrease—so, too, will the incentives and grants available to help with their purchase.

PG&E urges all fleet owners to examine their long-term fleet planning needs. The cost-savings potential will vary greatly by fleet depending on the number of vehicles, duty-cycles, and energy needs. There are many resources available to help fleet owners through this process, and PG&E is ready to help. For those operating in PG&E’s area, you can start by contacting an EV Fleet specialist or visiting pge.com/evfleet to get access to resources that can help at any stage of the electrification process.